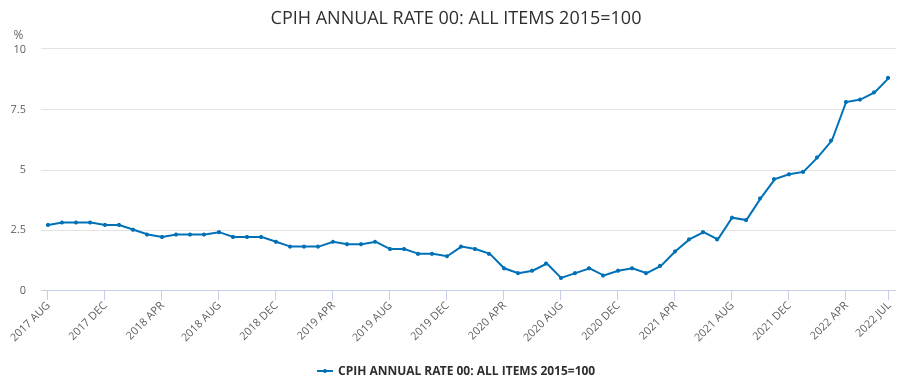

The Cost-of-Living crisis is worsening every day, making it challenging for many firms to control their rising costs. It is expected that the economy will shortly enter a recession, due to the 9.4% increase in consumer price inflation in June.

In an effort to conserve as much money as possible, consumers will spend less money on non-essentials which will reduce earnings for some businesses. Business owners will have to look hard at their current expenses to see where they can save more money.

Here at BMS, we want to support your business during these difficult times. This led us to start questioning how businesses can reduce their business expenditures. We’ve managed to come up with five top tips on how you can save money for your business.

Consumer Price Inflation, UK | Office for National Statistics

1. Make a revised budget

Making a revised budget should be the first step for firms. Businesses must adhere to a rigid budget now more than ever. How your company plans to handle the cost increases should be included in the amended budget. By reviewing your annual budget, you will be able to identify any possible wasteful expenditure and make expense reductions where possible. The new budget may allow you to transfer funds to departments that need it most. This can improve the decision-making process for you and your business, as well as improving the running of daily operations.

2. Get the right card machine for your business

One of the easiest ways to see if you can save money is to check your existing payments contracts. Many small businesses have been using Pay-As-You-Go card machines because of their convenience and rolling contracts. However, if your business consistently makes over £2,000, it is highly likely you would benefit more from changing to a traditional terminal contract rather than a Pay-As-You-Go.

However, in any card payment contracts there can still be unusually high rates and hidden charges for PCI compliance. The best way to see if you are being over charged is to check your bills thoroughly, and compare these to other contract. Although, it can be tricky to spot the hidden charges, but you can speak to an industry expert who can help examine your bill.

At BMS, we can offer you extremely competitive rates for your business. Our Expert Account Managers will happily audit your bills to make sure you are getting the best rates and are not paying more than you should be. So why not book a quick consultation with one of our experts today?

3. Understand Your Business Energy

With energy bills skyrocketing at the moment, it is important for businesses to make sure they are on the best energy rates. Unlike domestic users, businesses are not covered by the energy cap and therefore prices may keep going up uncontrollably. Businesses should start looking for a new contract with plenty of time remaining on their current one. This gives them time to shop around and find the best rates.

To save on their energy usage businesses should look at using the most energy efficient solutions. For example, using energy saving LED bulbs can save you up to 83% more than using traditional bulbs. In the long term, businesses should work towards moving to self-generation of energy by utilising renewable energy solutions. Switching to green solutions can lower costs for a business because they will be less reliant on the turbulent fossil fuel-based market.

4. Review Your Other Essential Business Expenses

On top of card payments and energy, you should also save on other business essentials, such as Business Insurance. Virtually all businesses will need insurance. The market for this is very competitive; therefore, if you research you will get competitive deals. This may require some comprehensive research, but you could make some big savings.

Thinking you don’t have time for researching cost-saving solutions? You could get in touch with a specialist that could do the comparison for you, and would be able to provide the best prices. Another example of business expenditures that could be reduced is your Telecoms. If your business makes a lot of phone calls, you could install a VoIP system. This may require an initial investment to install but in the long term you could make a good saving due to VoIPs low costs (in comparison to a traditional landline).

5. Seek expert advice

The Cost-of-Living crisis, which is affecting so many ordinary people and businesses, is steadily worsening. It’s possible that you won’t always be able to keep up with the business environments rapid change. Therefore, it’s crucial to consult with sector experts who can provide you with the most recent information.

By assessing whether you are eligible for special relief rates that some businesses would be entitled to, for instance, these experts might be able to save you money. Industry specialists would be in a strong position to recommend the most appropriate goods or services for your business, due to their expertise in a specific field.

So... What Are You Waiting For?

We hope that these tips will be useful for your business during these difficult times, and we hope you keep us in mind for helping you implement these cost-saving suggestions!

We want to ensure that your business is running to its highest potential. BMS can help you establish a simple financial process, to positively promote your business cash flow, alongside 24/7 help and other financial products.

So, what’s stopping you? Contact us today to improve your business and see how much you can save!